If you read my blogs, you already know that I mentioned my UITF journey in several of my posts. A note to the reading public though, I am not a financial advisor and certainly not an expert in financial management. What I write is normally just based on my understanding of what I read/researched and my experiences about UITF and investment in general.

So what really is UITF?

UITF or unit investment trust fund is an investment vehicle offered by banks to the investing public. It is a pooled funds (can be peso-denominated or dollar or other currencies) collected from investors and is managed by professional fund managers. In UITF, funds collected from the public are pooled together and invested in different financial instruments like bonds and equities.

UITF, though managed by professional fund managers, is not risk-free. It is subject to risk factors like changes in interest rates and stock market fluctuations. That’s why it is important that an individual find out his risk profile first before diving into UITF investments to minimize loses.

What is investment risk profile?

Investment risk profile is an individual’s evaluation of his ability to take risks on the money he’s going to invest. The areas subjected to evaluation include an individual’s financial capability in terms of his earnings, savings and investment time horizon. This means understanding the current financial state of an individual and the length of time one is able to let his money out for investment. Knowing an individual's risk profile is important to help find out the right portfolio appropriate to an individual's profile and to minimize the risks accompanied by this investment vehicle.

Investment risk profile is generally categorized into three; conservative, moderately aggressive and aggressive. Conservative investment profile means an individual can only accept minimal risk with minimum returns, one that's normally focused on preserving capital. Funds for conservative profile usually includes money market funds, a fund that seeks to invest on short-term fixed-income instruments and assets with high liquidity (ease of getting in and getting out of an investment) like treasury bills.

Moderately aggressive investment profile means an individual is willing to accept some risks and invests on medium-term instruments that offer higher returns. In moderately conservative profile, an individual is usually offered funds that both invest on liquid investment that offers fixed return on a slightly longer term like bonds. When I first enter into investment, I was classified as moderately aggressive and was asked how much of my fund will be put on to low risk instruments and how much to put on medium risk instruments. Back in 2013, I didn't quite understand this concept yet and just opted for a 50/50 ratio.

Aggressive investment profile on the other hand means you are willing to accept high risks for a possibility of much higher returns. In this profile, one seeks to maximize the growth of his funds on a long term horizon. Nowadays that I quite understand the risks that come with my investment, I purposely make sure that I get the aggressive profile so that I can invest on highly risky funds. These funds usually invest on equities and stock markets. This carries a lot of risks and there's a high probability of losing money. In order to counter the risks, I make sure to invest money that I won't be needing in the short term; money that I'm willing to let go for years, if need be. I also try my best to study market movement so that I would know somehow when to subscribe and unsubscribe to aggressive funds like what I'm doing with my BPI Invest Philippine Equity Index Fund. Of course, I can't exactly predict market movement so whenever the market goes against me, I do top-ups and accumulate shares. So far, with these strategies, I was able to ride the market fluctuations without losing money. I didn't earn that much but I definitely earn much higher return compared to just saving money on the bank, higher even compared to money market funds or time deposit.

Please note though that each and everyone of us is unique, our risk profiles are different, our financial situations are unique to us. What works for me might not work for you and vice-versa so please know yourself and your situation and do your own research before investing, be it small or considerable amount of money.

Where to invest in UITF?

As mentioned above, UITF is usually offered by banks. Many of the commercial banks in the Philippines offer UITF using Peso or other currencies, usually US dollar. Some of these banks include BPI, BDO, Security Bank, Metrobank, etc. Although majority of those that offered UITF are banks, there are investment companies that also offer UITF. One of these companies is ATRAM.

Of these companies and banks offering UITF, BPI, BDO and ATRAM (thru GCash) are the ones I’ve tried. Of the companies I tried, BPI and ATRAM are the ones I can recommend. I like BPI and I’d say it’s the most appropriate UITF bank for me. BPI’s certain funds (like BPI Invest Philippine Equity Index Fund, a fund that tracks the PSEI, the Philippines stock exchange index) has no holding period which means you can unsubscribe anytime you want to (Other banks require 30 days holding period which means you will be charged a fee if you unsubscribe before the 30-day period ends). In this BPI fund, peso averaging is also allowed, which means, if the unit value of this fund goes down, I can buy at lower prices and accumulate shares.

I also like ATRAM because even though I don’t have a dollar account, I can still subscribe to global funds. Other banks like BPI only offer global funds if you have a dollar account. The minimum initial investment is also usually high in global funds, from USD500 to USD1000. The minimum top-up amount, in case you want to accumulate shares is also high, at least USD200. In ATRAM, the minimum initial investment is PhP1000 and top-up amount is PhP500 making it quite accessible to all Filipinos, especially those like me who only has minimal amount to spare for investment.

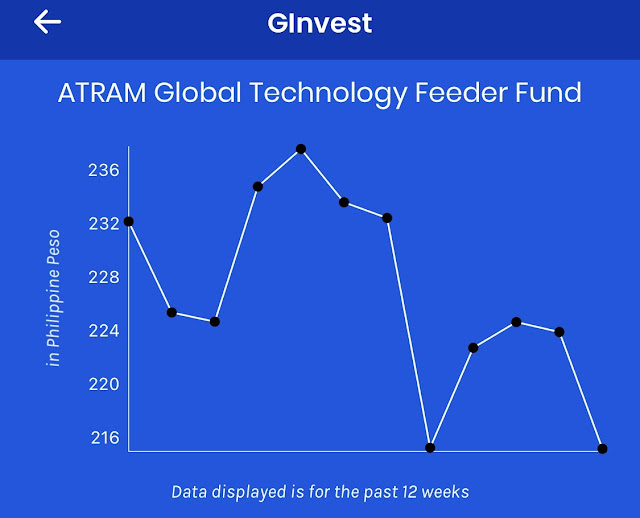

If with BPI, I normally subscribe and unsubscribe in fairly short period of time, sometimes a week or two, I can't quite do this with ATRAM. ATRAM has longer settlement period and unlike BPI Invest Equity Index Fund where I can easily monitor it by checking PSEI movement, ATRAM's global technology feeder fund is quite diverse that it's quite hard monitoring the securities they invest in. So for my ATRAM Technology Feeder Fund, I just accumulate shares on a pretty regular basis, every payday as much as possible. Will this work for me in the long term? Shall I get higher return from this fund in the future? As of now, I don't know. I'm giving this fund five (5) to ten (10) years to work. In this same period, let's also see the rate of return of my BPI Invest Equity Index Fund and compare these two (2) funds. Hopefully, both goes well. Wish me luck my dear readers, if there's any. 😉

~ oo00oo~

Blessed Sunday everyone.🙏 Stay safe and healthy!😊

hi

ReplyDelete